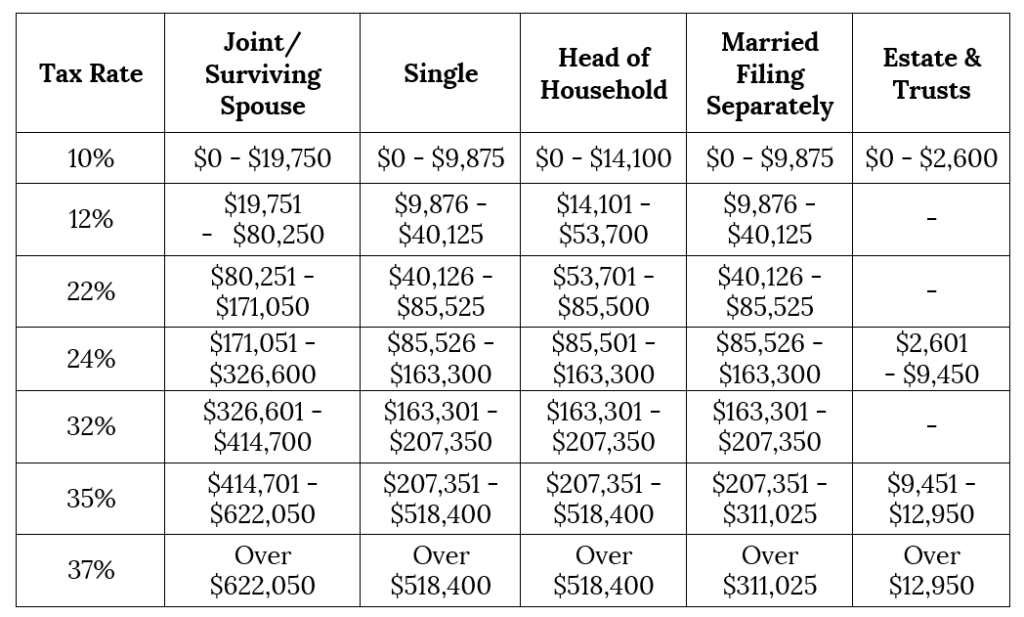

Even if you filed for divorce earlier in the year, the IRS states that you are still married if you don't obtain a divorce decision or judgment issued by a court on or before December 31.īy the end of the year, you must have finalized your divorce.Įven while you and your spouse are not required to live together, if you and your spouse are formally separated by court order, you cannot file jointly. It depends on how you define "legally married," which is the key phrase in this sentence. However, they are exclusively accountable for the truthfulness of the data on their returns and the payment of any taxes owed on their filings. Married taxpayers who submit separate tax returns cannot claim certain tax benefits. If you file jointly with your spouse, you'll be eligible for a bigger standard deduction and more lenient tax brackets. Those legally married on December 31, 2021, may file a joint 2021 return in 2022.

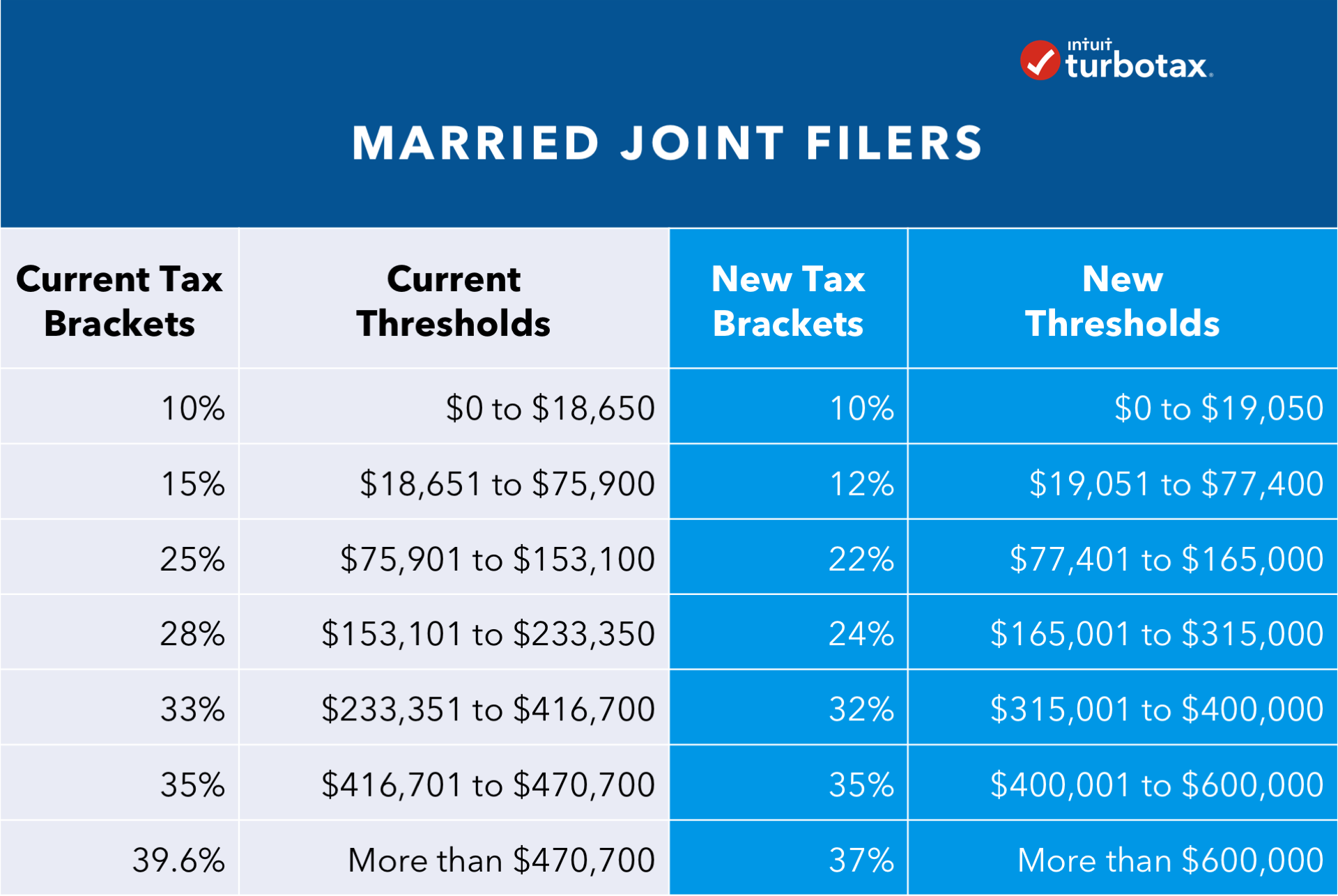

If you and your spouse were deemed legally wed on December 31, the final day of the tax year, you are eligible to submit a joint tax return. The option best for you and your spouse can be determined by considering several things. Filing jointly typically leads to greater tax savings. However, there can be some drawbacks as well. For various reasons, spouses can choose to file separate marriage returns, and some do. Just because two people are married doesn't mean the IRS requires them to file joint income tax returns. If a significant income gap between the pair and the lower-paid spouse is qualified for significant itemized deductions, couples without dependents or educational costs can generally profit from filing separately. It makes sense to compute the tax returns both ways if a couple isn't sure whether filing status will result in the largest refund or lowest tax bill. Whether married couples should file individually or jointly depends on various factors. It may be more advantageous to file separately, though, if both spouses are employed, their income and itemized deductions are substantial and drastically disproportionate. When only one partner earns a considerable income, filing jointly with your spouse is frequently the best option. A married couple can report their incomes, deductions, credits, and exemptions on the same tax return while filing their taxes as a married couple.

Married people who got married before the end of the tax year can file as married people filing jointly.

0 kommentar(er)

0 kommentar(er)